How Insurance Companies Use Satellite Imagery for Damage Assessment

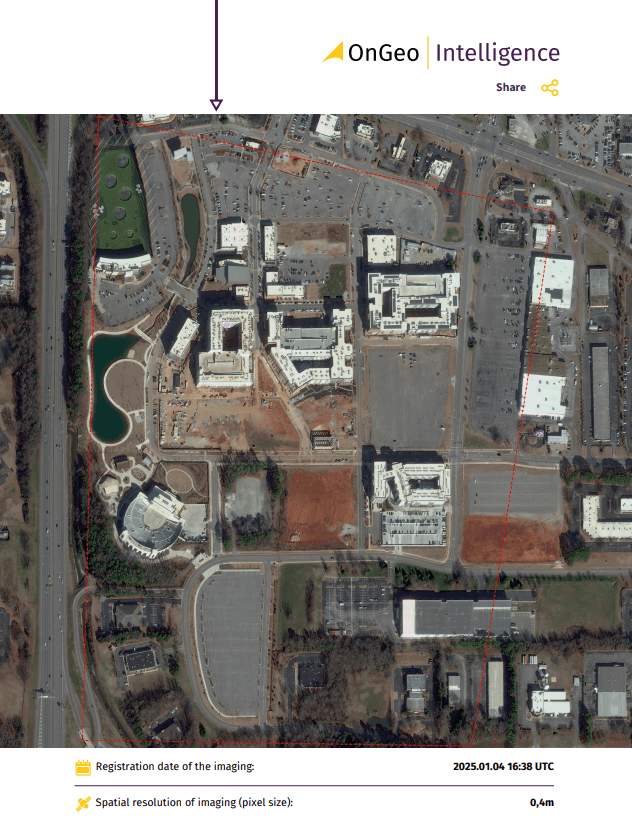

In an era defined by rapid technological advancements and escalating climate risks, insurance companies are increasingly turning to innovative tools to enhance their damage assessment processes. Satellite imagery has emerged as a game-changer, offering insurers unprecedented precision, speed, and scalability in evaluating claims and managing risk exposure. Platforms like OnGeo Intelligence provide high-resolution satellite imagery reports that empower insurers to assess damages remotely, optimize resource allocation, and combat fraud—transforming traditional workflows into data-driven operations.

The Role of Satellite Imagery in Modern Insurance

The insurance industry has long relied on on-the-ground inspections to assess damage following natural disasters, accidents, or other insurable events. However, these methods are often time-consuming, costly, and hazardous, particularly in the wake of large-scale catastrophes like hurricanes, floods, or wildfires. Satellite imagery addresses these challenges by providing a bird’s-eye view of affected areas, enabling insurers to analyze damage quickly and accurately without deploying field agents into dangerous zones.

OnGeo Intelligence stands out in this landscape by offering high-resolution satellite imagery reports with no contracts and instant access, making it a versatile tool for insurers globally. These reports deliver detailed, dated visuals of properties and landscapes, allowing companies to monitor changes over time, assess post-event damage, and validate claims with precision. Below, we delve into the key ways insurers utilize satellite imagery, supported by examples and insights from industry practices worldwide.

Practical Applications

Fraud Prevention and Claim Validation:

Insurance fraud is a major issue, costing companies billions of dollars annually. Satellite imagery helps insurers detect fraudulent claims by: Comparing pre- and post-event images to verify damage. Identifying inconsistencies in claims. Tracking environmental conditions to prevent false reports.

Natural Disaster Response:

In February 2025, North Queensland experienced severe flooding, leading to a surge in insurance claims. Companies like Suncorp utilized satellite imagery and flood mapping to estimate the impact. This technology provided near real-time insights into flood inundation, allowing insurers to understand the extent of the damage without immediate physical inspections.

Satellite imagery has become an invaluable tool for insurance companies, particularly in assessing and managing risks following natural disasters like the September floods in Poland. Reports featuring satellite imagery from OnGeo Intelligence provide detailed flood maps that play a critical role in several key areas: identifying high-risk zones, enabling insurers to prioritize resources and adjust premiums

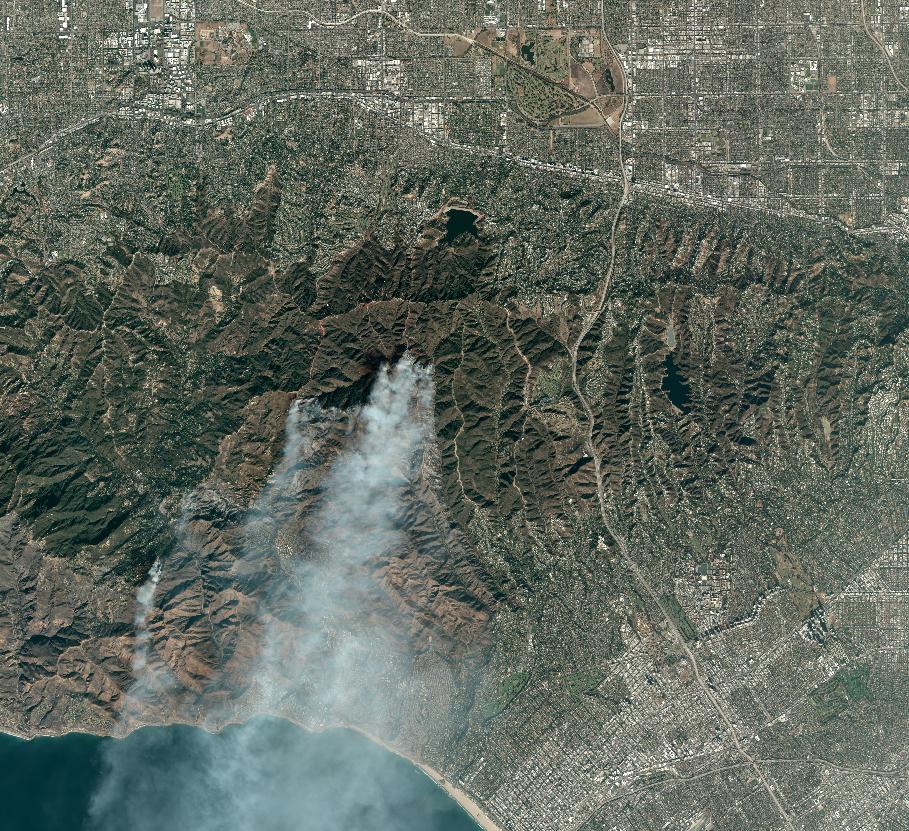

Similarly, powerful satellite imagery of wildfires in Los Angeles has helped experts understand the extent of destruction. Before-and-after satellite images provide valuable perspectives that aid in disaster response and recovery.

Satellite Imagery in Conflict and Disaster Zones:

Satellite images have proven crucial in assessing the scale of destruction in the Lebanon. By leveraging high-resolution Earth observation technology, experts have been able to track and analyze damage over large areas, providing an accurate and impartial perspective. Insurers have used satellite data to document the destruction of homes, businesses, schools, and essential utilities such as electrical and water systems.

Another example is the massive fire at the Moss Landing power plant on January 16, 2025. The analysis of satellite images proved invaluable in assessing the impact of the fire. By comparing satellite images from before and after the incident, experts can accurately determine the areas affected by the blaze. These high-resolution images provide crucial data for insurers to evaluate the damage.

Advantages of Satellite Imagery in Insurance

- Efficiency: Remote assessments reduce the need for on-site inspections, leading to faster claim resolutions.

- Accuracy: High-resolution images provide detailed views of affected areas, ensuring precise evaluations of damages.

- Cost-Effectiveness: Minimizing the reliance on physical inspections lowers operational expenses for insurance companies.

- Risk Assessment: Continuous monitoring allows for proactive risk management and better-informed policy decisions.

Why OnGeo Intelligence?

OnGeo Intelligence platform offers unique advantages: high-resolution imagery, instant delivery, and comprehensive historical data. Unlike competitors requiring long-term subscriptions, OnGeo Intelligence provides flexibility, making it ideal for insurers seeking cost-effective, on-demand solutions. Insurers worldwide can leverage accessible, high-quality imagery.

With accurate satellite evidence, insurers can:

- Reduce field assessment costs.

- Improve response times for policyholders.

- Strengthen data-driven decision-making processes.

The integration of satellite imagery into insurance operations is no longer a futuristic concept but a present-day reality.

Learn more about: Satellite Imagery Report

Conclusion

The integration of satellite imagery into damage assessment processes signifies a pivotal shift in the insurance industry. By embracing this technology, insurers can enhance their operational efficiency, provide timely support to policyholders, and better manage risks associated with natural and man-made disasters. The future of insurance isn’t on the ground—it’s in the stars.

Related articles

- Detection of Illegal Construction in Satellite Images

- Using Satellite Imagery As Evidence In Judicial Proceedings

- Tracking Urban Changes with SaUrban Change Detection with Satellite Imageryellite Imagery: How Change Detection Reveals City Transformations

- Etna's Eruption Seen from Space: What Satellite Images Reveal

- Satellite imagery of Gaza reveals the massive scale of destruction