Satellite Imagery for Insurance Claims Assessment

Insurance claims assessment has long depended on on-site inspections and manual reporting-methods that are slow, costly, and hard to scale after major disasters. As climate risks and claim volumes rise, insurers need faster and more reliable ways to assess damage.

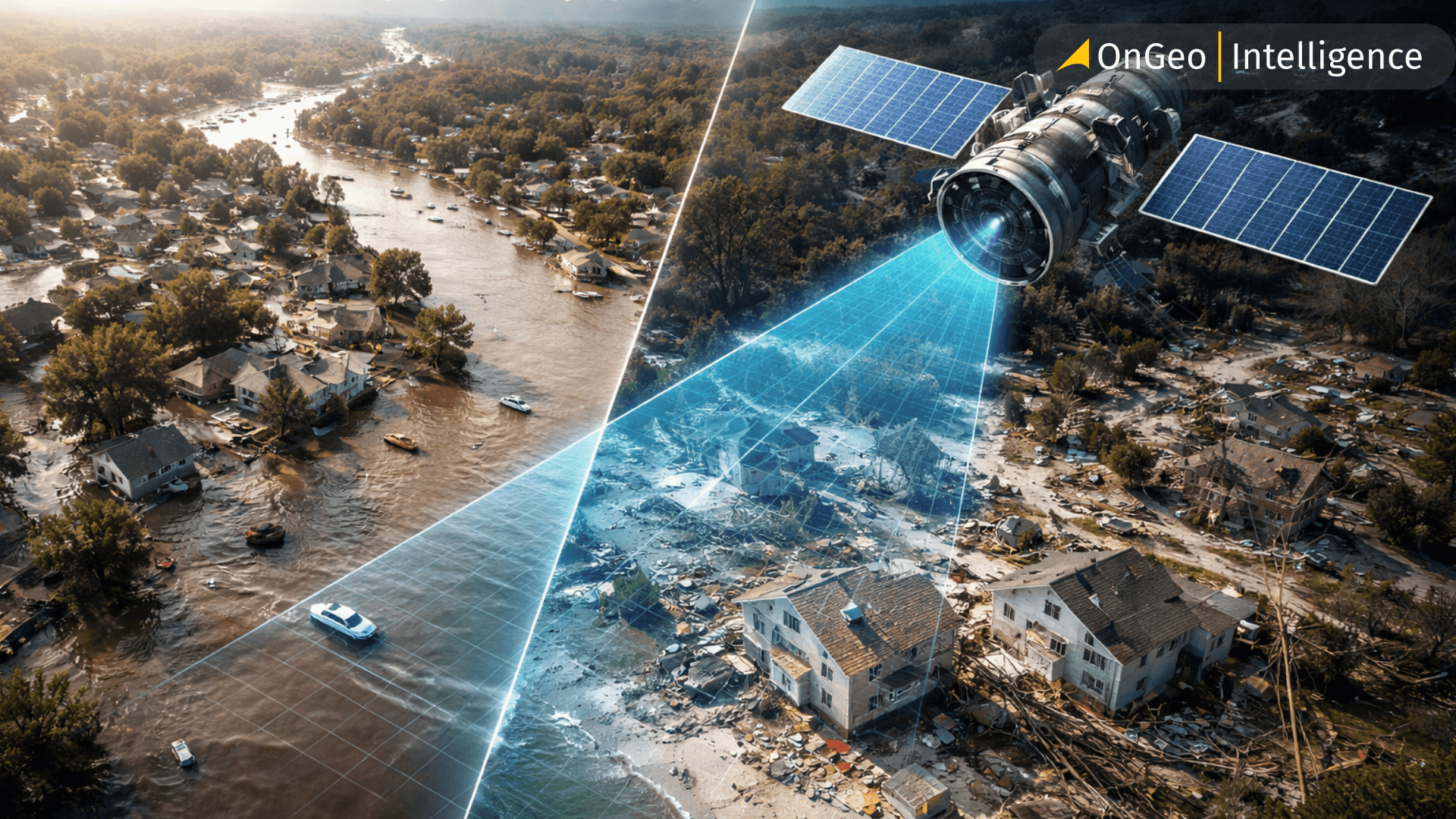

Satellite imagery is transforming this process by enabling remote damage assessment, claim verification, and inspection prioritization through before-and-after views of insured assets. In this article, we explore how insurers use satellite data across the claims lifecycle and how platforms like OnGeo Intelligence make geospatial insights more accessible for insurance workflows.

Pre-Loss Risk Assessment Using Satellite Imagery

Satellite imagery plays a key role in insurance claims assessment by enabling insurers to analyze property risk before a loss occurs. High-resolution satellite imagery provides objective baseline data on roof condition, building footprint, surrounding vegetation, and proximity to flood zones or critical infrastructure. These pre-loss insights support more accurate risk evaluation and underwriting, while also creating a verifiable reference point for future insurance claims assessment. Establishing baseline records with satellite imagery helps insurers clearly distinguish between pre-existing damage and losses caused by insured events.

Post-Event Insurance Claims Assessment and Verification

After natural disasters such as floods, wildfires, hurricanes, or earthquakes, satellite imagery enables fast and scalable insurance claims assessment across large geographic areas. By analyzing recent satellite imagery and comparing it with pre-event data, insurers can verify claims, estimate damage severity, and confirm whether reported losses align with the timing and cause of the event. Before-and-after satellite imagery comparisons support objective damage assessment, improve consistency in claim decisions, and help reduce fraudulent or inaccurate insurance claims.

April 2025, Biebrza National Park, Poland’s - before and after satellite imagery fire

Large-Scale Claims Response and Inspection Prioritization

During catastrophic events, insurance companies often face a surge in claims that challenges traditional assessment methods. Satellite imagery supports rapid claims triage by identifying affected properties and categorizing damage levels remotely. This allows insurers to prioritize on-site inspections, allocate adjusters more efficiently, and accelerate insurance claims assessment without compromising accuracy. By complementing field inspections, satellite imagery helps reduce operational costs and shortens claim resolution times during high-volume events.

Before-and-After Imagery in Practice (With Examples)

Before-and-after satellite imagery is one of the most effective ways insurers use remote sensing during claims assessment. By comparing images captured before a loss event with imagery acquired afterward, insurers can objectively verify damage, estimate impact, and resolve claims faster.

May 28, 2025, the serene alpine village of Blatten in Switzerland’s Lötschental Valley - before and after satellite imagery Landslide

Example 1: Roof Damage After a Storm

An insurer receives multiple claims following a severe windstorm. Using satellite imagery from a few weeks before the event, the claims team establishes the pre-loss condition of rooftops across the affected area. Post-event imagery shows visible roof material loss, exposed underlayment, or debris patterns on specific properties.

This comparison helps confirm which homes experienced storm-related damage and which roofs were already in poor condition, reducing disputes and unnecessary site visits.

Example 2: Flood Damage Verification

After heavy rainfall and river overflow, satellite imagery is used to map flood extent across an entire region. Pre-event images show normal land and property conditions, while post-event imagery reveals standing water, soil saturation, and access road inundation.

Claims adjusters can quickly verify whether a property was actually within the flooded zone and estimate the duration and severity of exposure, which is critical for determining coverage and compensation.

Example 3: Wildfire Impact Assessment

In wildfire-prone regions, before-and-after imagery is especially valuable. Pre-fire images show vegetation density and building surroundings, while post-fire imagery highlights burn scars, destroyed structures, and altered landscapes.

Insurers can assess total loss versus partial damage remotely, even when access to the area is restricted due to safety concerns.

Example 4: Property Alterations and Dispute Resolution

Before-and-after imagery is also useful when claims involve disputes. For example, a claimant reports structural damage following a recent event, but satellite images reveal that the damage was present months earlier.

This objective visual evidence helps insurers make defensible decisions while maintaining transparency with policyholders.

Example 5: Large-Scale Event Triage

During hurricanes or earthquakes, insurers may face tens of thousands of claims at once. Satellite imagery allows claims teams to compare pre- and post-event conditions across entire cities, categorizing properties by visible damage severity.

This enables faster prioritization, ensuring that the most severely affected policyholders receive attention first.

Why This Approach Works

Before-and-after imagery provides:

- An objective, time-stamped record of property conditions

- Faster claim verification without immediate field inspections

- Reduced operational costs and safer assessments in hazardous areas

- Clear documentation that supports fair and consistent decisions

In practice, this approach doesn’t eliminate human adjusters-it enhances their effectiveness by giving them reliable visual context before they ever step on-site.

How OnGeo Intelligence Fits Into Insurance Workflows

While many insurance-focused startups rely on complex AI models and tightly integrated enterprise systems, OnGeo Intelligence fills a complementary and highly practical role in insurance workflows: fast, transparent access to satellite imagery and change analysis without technical barriers.

1. Rapid Pre-Loss Risk Context

Before a policy is issued or renewed, insurers often need visual context of a property and its surroundings. OnGeo Intelligence allows users to quickly generate satellite reports showing:

- Building footprints and land use

- Surrounding vegetation, water bodies, and terrain

- Historical imagery for basic change detection

This helps underwriters validate risk conditions without site visits or specialized GIS tools.

2. Before-and-After Damage Assessment

For claims processing, one of the most powerful uses of satellite imagery is comparing conditions before and after an event such as floods, fires, storms, or landslides. OnGeo Intelligence supports this by:

- Providing access to multi-temporal satellite scenes

- Presenting imagery in a clear, side-by-side visual format

- Enabling non-technical users to interpret changes quickly

This visual evidence can support claim validation, dispute resolution, and internal review processes.

3. Faster Triage and Prioritization

After large-scale events, insurers often face thousands of claims at once. OnGeo Intelligence can be used as an early triage tool to:

- Identify heavily impacted areas

- Prioritize claims that likely involve severe damage

- Allocate field inspectors more efficiently

By narrowing down high-impact zones, insurers reduce response times and operational costs.

4. No Technical Overhead

A key differentiator of OnGeo Intelligence in insurance workflows is accessibility:

- No subscription or account setup required

- No GIS or remote sensing expertise needed

- Reports delivered in a readable, shareable PDF format

This makes OnGeo Intelligence especially useful for claims teams, legal departments, and decision-makers who need insights quickly without learning new software.

This makes it suitable for insurers of different sizes, including smaller firms or regional providers without large geospatial teams.

Industry Examples: Startups Using Geospatial Data in Insurance

As satellite and aerial imagery become increasingly integrated into insurance workflows, several startups are applying geospatial data and machine learning to solve specific industry challenges. These examples show how imagery is transforming risk assessment, underwriting, and claims processing across the sector.

Cape Analytics

Focus: Property insights through geospatial analysis

Cape Analytics uses high-resolution aerial and satellite imagery combined with computer vision to extract property-level characteristics. Their models generate detailed risk attributes such as roof condition, surface materials, building footprint, and surrounding vegetation.

Use case: Underwriting and risk pricing

Insurers use Cape Analytics to improve underwriting models and predict risk factors that were previously unavailable or costly to obtain through manual inspection.

ZestyAI

Focus: AI-driven property and hazard risk modeling

ZestyAI applies deep learning to satellite and aerial imagery to assess climate-related risks such as wildfire and flood exposure. Their models estimate property vulnerability and quantify potential loss impacts.

Use case: Pre-loss risk scoring and portfolio analysis

By combining historical imagery with predictive models, insurers gain insights into risk concentrations and can refine pricing and mitigation strategies.

Nearmap (Insurance Solutions)

Focus: Frequent, high-resolution aerial imagery

Nearmap provides regularly updated aerial imagery with very high spatial resolution. While not limited to satellites, this imagery complements satellite views with detailed roof and structure visuals that insurers find particularly useful.

Use case: Post-disaster inspection and damage verification

Nearmap’s frequent capture schedule enables rapid assessment of neighborhoods after events like storms or hail, supporting field teams with accurate visual context.

Other Notable Players (Emerging / Adjacent)

While not exclusively insurance focused, the following companies demonstrate broader trends in geospatial data application that insurers increasingly leverage:

- Descartes Labs – Geospatial analytics platform used for risk modeling and supply chain insights

- Planet Labs – Daily satellite imagery feeds used for near-real-time event monitoring

- Orbital Insight – Large-scale change detection and economic activity analysis from satellite data

Each of these startups contributes to the broader ecosystem that makes geospatial intelligence more actionable and relevant for insurance applications - from real-time monitoring to large-scale risk assessment.

What These Examples Tell Us

Across these companies, there are several common themes:

- Automation and machine learning are enabling scale in image interpretation

- Pre- and post-event analysis is central to both underwriting and claims

- Visual data accelerates decision-making and reduces reliance on manual processes

- Geospatial insights complement traditional actuarial models rather than replace them

This ecosystem demonstrates that satellite and aerial imagery are becoming embedded in insurance workflows, not as standalone tools but as data sources that feed risk models, operational dashboards, and automated decision systems.

Why This Matters

As insurers increasingly rely on geospatial data, tools that lower the barrier to accessing satellite imagery become critical. OnGeo helps bridge the gap between advanced satellite data and everyday insurance operations-making satellite intelligence usable, understandable, and actionable across the insurance value chain.

Satellite Imagery: The New Standard in Claims Assessment

Satellite imagery is becoming an essential part of modern insurance, enabling faster, more objective risk assessment and insurance claims validation without relying solely on on-site inspections. Its value lies not only in the data itself, but in making reliable, time-stamped evidence accessible to everyday insurance workflows.

Platforms like OnGeo Intelligence lower the barrier to using satellite imagery by providing easy access to before-and-after visuals that support human judgment, reduce uncertainty, and speed up claims decisions. As climate-related events continue to increase, satellite-based evidence is set to become a standard, rather than an optional, tool in insurance claims assessment.

Related articles

- From Space to Shore: How Earth Observation Satellites Help Monitor Water Quality

- Satellites vs. Deforestation: Monitoring Earth's Forests

- How to Master Satellite Image Analysis: A Beginner's Step-by-Step Guide

- Orthorectification: The Hidden Hero of Satellite Imagery in GIS

- Satellite Imagery Exposes 19 Rare Earth Mines Threatening Mekong River Pollution

- Unlocking the Past: How to Search for Historical Satellite Imagery

- Satellite imagery of Gaza reveals the massive scale of destruction

- LA wildfires: Satellite images expose the scale of destruction